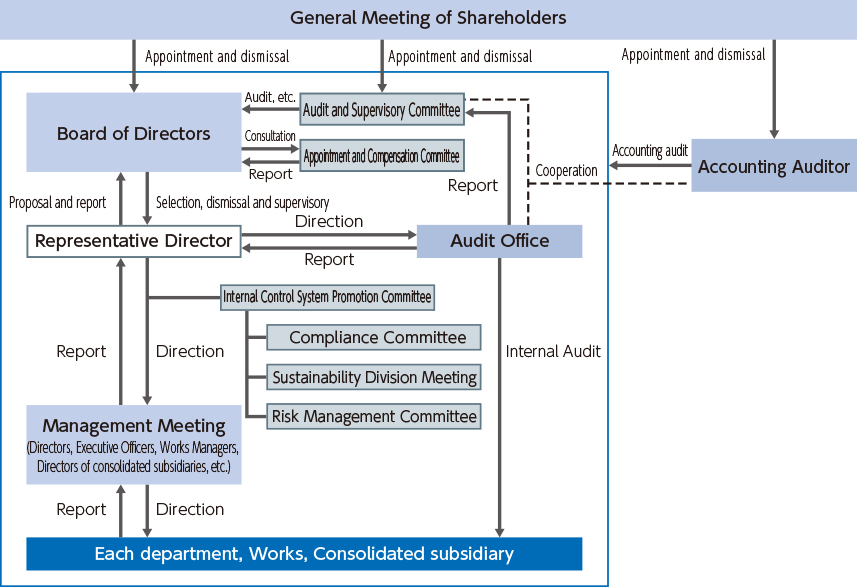

Corporate governance structure

Basic stance on corporate governance

In order to improve transparency and soundness in our corporate management, Daiseki positions corporate activities that are in compliance with the laws, regulations, and social norms as our top priority. We have adopted an Audit and Supervisory Committee system and formed an Audit and Supervisory Committee consisting of three outside directors to further enhance the supervisory function of our Board of Directors. One of the outside directors is a woman and provides advice from her unique perspective as a woman. In May 2020, we introduced the Executive Officer System in order to clarify the responsibilities regarding business execution, improve management efficiency, and speed up decision-making. The authority necessary for conducting daily corporate activities is delegated to the Works Manager at each Works and the President of each Group company, and we hold management meetings attended by the directors, executive officers, the Works Managers of each Works, and the directors of each Group company. To further strengthen the governance of the Company, in May 2023, we added a person with experience as a corporate manager as one additional outside director, creating an organization where the majority of directors are outside directors.

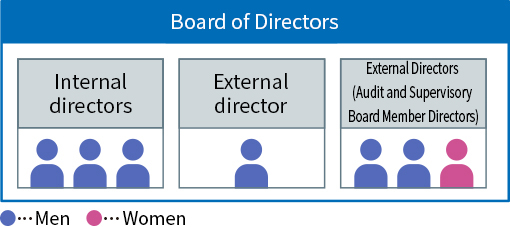

Board of Directors

The Board of Directors is comprised of seven members: three internal directors, one external director, and three external directors who also serve as Audit and Supervisory Committee members. Of these members, one is a female director, contributing to a more diverse Board composition. In addition to regular Board of Directors meetings which are held once per month in principle, extraordinary Board of Directors meetings are held as necessary. The Daiseki Group holds Board of Directors meetings more frequently with the aim of facilitating prompt and accurate decision-making and efficient organizational management of the Group as a whole.

In addition, an executive officer system has been introduced for more efficient and accelerated execution of duties as well as clearer responsibility by separating the execution function from decision making and supervisory functions of management, aiming at establishing an agile and efficient management system. Board of Directors functions as the management decision making and supervisory body, while Management Meeting serves as the business executing body based on the decision making of Board of Directors. Board of Directors decides terms stipulated by the laws, regulations, or the articles of incorporation, important matters of Daiseki and our Group companies.

Sustainability governance by the Board of Directors

Our Sustainability Headquarters consists of the President and other executive officers of Daiseki and the presidents of Group companies. It meets twice a year to discuss and formulate important matters, including environmental conservation, climate change issues, and risk management related to human capital. The General Manager of the Headquarters of Planning and Management is appointed by the President as the person responsible for integrated environmental management and to be in charge of the environmental area such as climate change issues. The General Manager submits a specific plan to the Sustainability Headquarters and then the Sustainability Headquarters deliberates and formulates that plan. The contents of the plan and its progress are reported at the Board of Directors meetings.

Meeting frequency

・In principle, held once a month (or held at any time as needed)

Priority themes for FY2025

- ・Acquisition of treasury stock

- ・Acquisition of land for business expansion

- ・Explanation of credit decisions regarding large transactions of Group companies

- ・Thorough implementation of safety measures

- ・Tender offer for shares of Osaka Yuka Industry Ltd.

Management Meeting

The Daiseki Group separates management decision making and execution of duties: Board of Directors functions as the management decision making and supervisory body, while Management Meeting serves as the business executing body based on the decision making of Board of Directors. Directors, executive officers, business site managers, directors of consolidated subsidiaries, and others attend monthly Management Meeting. Management Meeting is responsible for setting targets and budgets by business divisions, monthly and quarterly performance management, and implementation of improvement measures. Striving to establish internal control, Headquarters of Business Generalization and Headquarters of Planning and Management provide instructions and requests in the fields of compliance, respectively in the Management Meeting.

Audit and Supervisory Committee

Held on a monthly basis in general, Audit and Supervisory Committee consists of three external directors with no mutual interest with the Daiseki Group. Audit and Supervisory Committee is responsible for reporting, consultation, and resolution of important matters related to audit and other related activities.

Meeting frequency

- ・In principle, held once a month (or held at any time as needed)

Specific matters considered by the Audit and Supervisory Committee

- ・Internal control system preparation and situation of operation

- ・Reasonableness of audits by accounting auditors

- ・Situation of internal control construction

- ・Situation of execution of duties by directors and employees, etc.

Major activities of the Audit and Supervisory Committee members

- ・Attendance at Board of Directors meetings and other important meetings

- ・Attendance at audit review meetings, audit result briefings, etc.

- ・Exchange of opinions with directors and employees

- ・Reading and examination of important decision documents, etc.

Priority themes for FY2025

- ・The Audit and Supervisory Committees of Daiseki and Daiseki Eco. Solution exchanged opinions to strengthen Group governance (March 2024)

- ・The presidents of the Group companies provided an overview of their operations (Daiseki MCR in November 2024, System Kikou in December 2024)

- ・Plant tour at Daiseki Kyushu Works (December 2024)

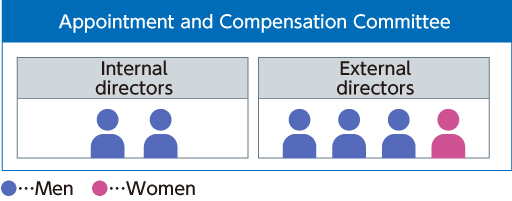

Appointment and Compensation Committee(2021~)

Appointment and Compensation Committee, an optional advisory body of directors aiming at enhancing independency, objectivity, and accountability of the function of Board of Directors in terms of appointment, dismissal, and compensation of directors, has been established. Appointment and Compensation Committee, whose majority of members consist of independent external directors, enhances objectivity and equity in processes to determine appointment, dismissal, and compensation of directors by discussing appointment and compensation of directors as well as by providing the discussion results and relevant advice and recommendation to Board of Directors.

Meeting frequency

- ・In principle, held once a month (or held at any time as needed)

Specific matters considered by the Appointment and Compensation Committee

- ・Matters concerning the selection and dismissal of directors, the maximum amount of remuneration for directors, and the level of remuneration for directors

- ・Other matters deemed necessary by the Board of Directors

Executive remuneration

The directors (except for the Audit and Supervisory Committee members and outside directors) are paid basic remuneration and stock-based compensation as fixed remuneration. The outside directors (except for Audit and Supervisory Committee members) are paid basic remuneration.

We use a remuneration system that is linked to shareholder returns so that it functions as an incentive to sustainably increase corporate value and to improve the practice and promotion of sustainable management. The basic policy for deciding the compensation to be paid to individual directors is to set an appropriate level based on their respective responsibilities.

Compensation to outside directors (Audit and Supervisory Committee members) is determined through discussions at the Audit and Supervisory Committee within the maximum amount resolved at the General Meeting of Shareholders.

The Appointment and Compensation Committee has been established as a voluntary advisory body to the Board of Directors. This committee determines policy on matters such as compensation, deliberates matters such as the details of the compensation for individuals, and provides advice and recommendations to the Board of Directors on the results of its deliberations.

Governance of Group companies

The Daiseki Group is implementing various initiatives such as the following to strengthen the governance of its Group companies.

●Management meetings

A management meeting is held every month with the attendance of the Daiseki directors and executive officers, each Works Manager, and the directors of Group companies. At these management meetings, important matters are instructed, notices are communicated, and opinions and information are exchanged.

●Dispatch of Directors to Group companies

For the governance of the Group, Daiseki sends one director each to Daiseki MCR, System Kikou, and Hokuriku Daiseki.

●Strengthening of communication with Group companies

Since FY2024, as a measure to gain an understanding of the actual status of Group companies and to strengthen communication, the Daiseki Headquarters of Business Generalization, which is in charge of promoting business activities, and Headquarters of Planning and Management, which is in charge of compliance, have been holding individual company management meetings with Group companies. The meetings discuss a wide range of issues, including checking the progress regarding business performance, discussing management issues, and the requests for support from Daiseki.

Accounting Audit

Daiseki has entered an audit contract with Azusa Audit Corporations, a KPMG Japan member firm, to have accounting audits and internal control report audits conducted based on the company law and the Financial Instruments and Exchange Act.

Internal Audit

Consisting of dedicated staff members, Audit Office under the direct supervision of the President and Representative Director audits the effectiveness of internal control and operational efficiency, etc. on a regular basis based on the audit plan, and reports the results to the President and Representative Director. Audit and Supervisory Committee and Audit Office mutually report their audit methods, states of internal control, and audit result, as well as exchange information as appropriate, engaging in enhancement of the audit function to conduct effective operational audit in cooperation with the accounting auditor.

Corporate Governance Report

For details of Daiseki's corporate governance, refer to "Corporate Governance Report" submitted to Tokyo Stock Exchange.

Corporate Governance Report(PDF:163KB)

Evaluation of Board of Directors' effectiveness

Daiseki evaluated the Board of Directors meetings held in the following period, the results of which were reported and discussed by the Board of Directors. The evaluation results are as follows.

Task implemented

●Evaluation subject

- Board of Directors Meetings held from September 2023 through September 2024

●Person in charge of evaluation

- All Directors

●Overview

-

Items to be evaluated

- ●Composition and operation of the Board of Directors

- ●Management strategy and business strategy

- ●Discussions at the Board of Directors

- ●Operation of the Board of Directors

- ●Dialogue with external directors

- ●Effectiveness of governance system and the Board of Directors

- ●Other topics for discussion by the Board of Directors

Analysis and evaluation results

●Questionnaire results

- Generally positive

●Effectiveness of Board of Directors

- Confirm that it is generally secured

Measures to realize effectiveness

●Four items pointed out as improvement was required were as follow.

- ●Consider establishing standards for important subjects such as medium- to long-term plans and financial strategy, and creating opportunities for full discussions at important meetings, including those of the Board of Directors.

- ●Based on the results of discussions at Board of Directors meetings, consider strengthening the governance of the group as a whole through prompt information sharing and full reporting of results group-wide.

- ●Consider increasing the diversity of the Board of Directors through in-house training of female director candidates, as one of the goals included in the Priority Policy for Women’s Activities and Gender Equality is to raise the ratio of female directors in prime companies to at least 30% by 2030.

- ●Consider creating opportunities for inspections of group companies and discussions with group company presidents and others regarding their medium- to long-term management issues and sustainability efforts.

Directors skill matrix (as of May 22,2025)

The selection of directors for the Board of Directors is based on the number of directors necessary to make accurate and prompt decisions, and with consideration of the balance of knowledge, experience, and abilities and the diversity of the Board of Directors as a whole. The selection criteria include that directors must be popular as individuals, have the insight to ensure compliance with laws, regulations, and corporate ethics, and have excellent judgment, decision-making ability, achievement-oriented ability, and self-control.

| Name | Position | Age | Gender | Years served |

Committee | C | I | B | G | S | A | F | St | T | H | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nom | Audit | |||||||||||||||

| Tetsuya Yamamoto | Representative Director | 60 | Male | 30 | 〇 | ● | ● | ● | ● | ● | ||||||

| Yasuo Ito | Representative Director | 52 | Male | 15 | 〇 | ● | ● | ● | ● | |||||||

| Koji Amano | Director | 64 | Male | 22 | ● | ● | ● | |||||||||

| Mitsuru Okada | Independent External Director | 68 | Male | 2 | 〇 | ● | ● | ● | ||||||||

| Norikazu Sahashi | Independent External Director | 66 | Male | 9 | 〇 | 〇 | ● | ● | ● | |||||||

| Masaki Maeda | Independent External Director | 50 | Male | 1 | 〇 | 〇 | ● | ● | ● | ● | ||||||

| Ayako Suganuma | Independent External Director | 67 | Female | 1 | 〇 | 〇 | ● | ● | ● | |||||||

-

Nom: Nomination and Remuneration Committee; C: Corporate management; I: Industry knowledge; B: Business strategy; G: Global;

S: Sales and marketing; A: Administrative risk; F: Finance and accounting; St: Sustainability; T: Technological innovation;

H: Human resources, education, and diversity

Reasons for selection as necessary skills

| Corporate management | As we face major changes in the business environment as an environmental value-creation company, directors need to use their foresight and insights gained through experience in corporate management to make appropriate decisions on the Group’s overall management and medium- to long-term management strategy, so we identified "corporate management" as an important skill |

|---|---|

| Industry knowledge | Directors should have the broad knowledge and experience needed for the management of the Group overall and for medium- to long-term management, and we identified "industry knowledge" as an important skill for making appropriate management decisions |

| Management strategy | For purpose-driven management, directors must have information gathering, information analysis, and logical thinking abilities, and need to develop management strategy based on the growth vision for the entire Group and the changes in the market, so we identified "management strategy" as an important skill |

| Global | In order to cope with the rapid changes in global society and the economy, directors need to reflect global perspectives into the development of the medium-term management strategy for the entire group, so we identified "global" as an important skill |

| Sales and marketing | For the sustainable growth and improved branding of the Group, directors need to collect, analyze, and utilize a variety of information related to the products and services demanded by the market, and to conduct planning, formulation, and execution, so we identified "sales and marketing" as an important skill |

| Management risk | To aim for the sustainable growth and enhanced corporate value of the Group, directors need to give appropriate advice based on extensive knowledge and experience to strengthen governance systems based on appropriate risk management, so we identified "management risk" as an important skill |

| Finance and accounting | In order to build a system for accurate financial reporting and a strong financial base, and to pursue sustainable growth and the enhancement of corporate value, directors need to have knowledge of finance and accounting, and the financial knowledge and experience for planning and executing business restructuring and M&A, so we identified "finance and accounting" as an important skill |

| Sustainability | Directors need to have the knowledge required for company management that seeks to contribute to the realization of a circular economy and a sustainable society, and to support management that aims to improve the sustainability of the business, so we identified "sustainability" as an important skill |

| Technological innovation | Promoting technological innovation will be necessary for the Group to continue sustainable development and to contribute to the realization of a circular economy society, so we identified "technological innovation" as an important skill |

| Human resources, education and diversity | To realize sustainable growth, it will be necessary to have education and training to maximize the abilities of employees and initiatives to promote diversity, to encourage employee growth while making the most of their individuality and enabling them to work the way they want to work, so we identified "human resources, education and diversity" as an important skill |